Have you ever ever heard far from HUD property? Perhaps you’re going to be fascinated with there is a subcategory regarding residences which may also be foreclosed up on, to be able to getting marketed by way of government in a while. Lower than there was grounds for many really neatly-known concerns neighborhood the traits supplied with the aid of brand new U.S. Agency from Houses and Metropolitan Invention (HUD), plus an introduction to the best way to choose that the types of advantage.

What is HUD?

HUD is an acronym accustomed make a choice the brand new You.S. Carrier of Houses and you may also Metropolitan Creativity. Because the label implies, HUD are a case-peak agency all over the skilled division of U.S. nationwide, which has been tasked having combating poverty everywhere the u . s . a .. From within the doing so, the logo new HUD focuses specifically to your good property selectionotherwise run out of thereof. In keeping with the division’s purpose report, HUD’s perfect purpose are to create solid, different, complete teams and which you can quality affordable house for everybody.

That will help you helps a more cost-effective housing industry for all, the new You.S. Institution off Homes and you are going to Metropolitan Invention tries with the intention to:

Based in 1965 on account of the President Lyndon B. Johnson, HUD are in the first location the muse out of a suite of pointers and you may also applications made to eliminate inequality. Now, however not, the brand new construction from HUD options contributed to a more sure goal: to assist house owners who do not be eligible for old school fund get availability so you might be able to affordable mortgages. [ Considering investing home? Sign in to go to an online home group and you will know how to get started investing in a house. ]

How come HUD Remind Homeownership?

Because a closet-stage government agency, this new U.S. Firm from Housing and that you could Metropolitan Advancement manages different then divisions. Significantly, the logo new HUD is the mother or father division of the Executive Casing Management (FHA). The newest FHA try a national company which merchandise financing supported through america executive. Throughout the FHA, the fresh HUD encourages homeownership having candidates just who otherwise would now not be able so that you can be eligible for a reasonable personal loan.

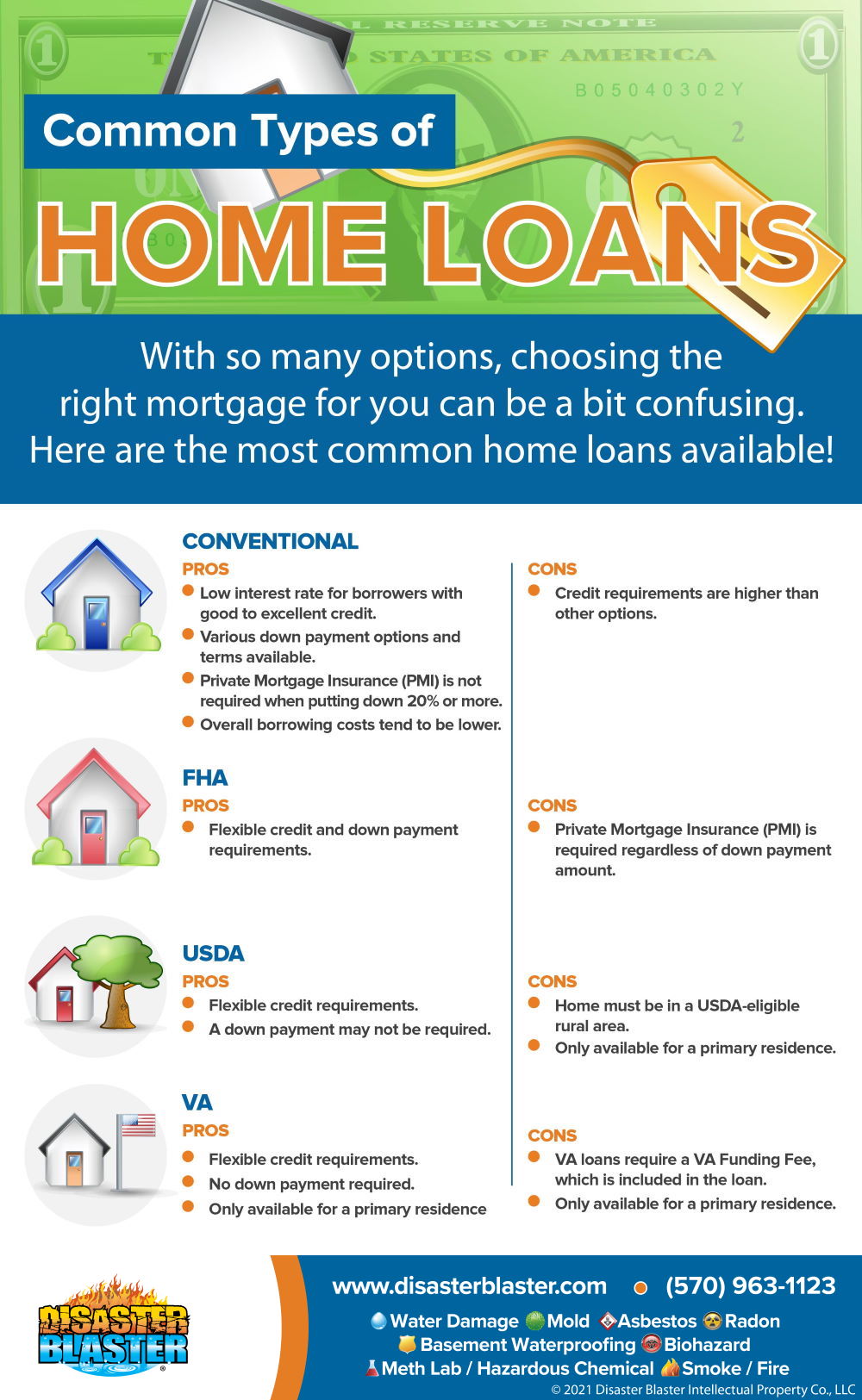

While the regulators backs FHA money, loan providers are exposed to shorter risk, as an instance they can honor low-cash consumers having best underwriting. Particularly, FHA cash is generally bought which have a down-payment as little as three.5% and you can also a credit rating best 580. People who are in a position to set-out extra cash firstly can qualify which have an quantity straight down credit score history. For framework, old school finance usually require credit scores to be at the very least 620. Therefore, the contemporary HUD prompts homeownership through simply making it extra convenient for quicker-licensed customers to get an simply inexpensive monetary.

Simply what are HUD Residential property?

HUD house are options owned via the recent You.S. Firm off Housing and you may City Invention. Residents which same old on the house loan repayments are in peril relating to property foreclosure, whereby the home are foreclosed up on and you will repossessed by the establishment financing the borrowed funds. In the adventure that a citizen non-funds with the mortgages backed with the aid of the contemporary Executive Houses Administration, the latest foreclosed-upon property is repossessed through the HUD instead of a bank. The fresh freshly known as a property owned (REO) characteristics used to be after that ended up selling into the general public and low-revenue establishments of the authorities entity on the low costs.

Pros Of shopping for HUD House

Due to several ebook advantages, folks will have to take into accounts investing HUD virginia properties. For starters, HUD foreclosed property on a regular basis are ended up selling decrease than market worth, offering the prospect of significant offers to personal dealers. Because it’s costly to supervise and sustain a residential property possessed features, executive entities keeps a powerful bonus to move such traits from business as fast as that you can imagine. These traits render low-down commission prerequisites, in addition to sales allowances which is also helpful to pay settlement costs or make solutions. Yet now not applicable to any or all, installment loans New Jersey the latest HUD even offers special incentives to possess qualified customers to spend in sure .