Funding an ADU could be difficult, however the use of your own home guarantee are going to be a great way that will help you receive the cash you desire to. This information demonstrates how it works

Secret Takeaways:

An ADU (accent grasp product) was once an inclusion connected with your own home, freestanding, or changing empty room (specifically a garage) to increase usable habitable space at your place of dwelling

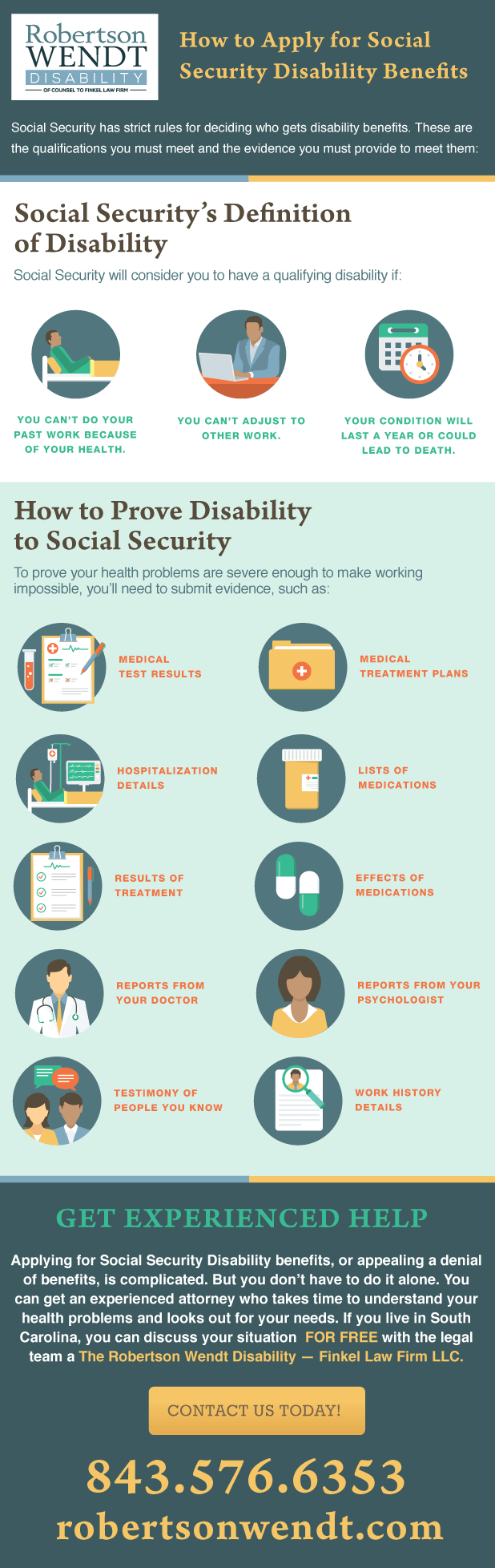

Capital choices for an enthusiastic ADU is folks that faucet into household guarantee (including house equity loans, household equity private strains of credit, and refinancing) and others (comparable to for instance design financing, signature loans, or retirement coupons ranges)

Playing with a house security private line of credit score (or HELOC) is very effective as it may well undoubtedly provide a low hobby, reimbursement independence, and more advantageous borrowing electricity

Connection House Gear, or ADUs, is a famous method to enhance living area, reinforce value of, and you’ll prepare for the close to future. An ADU will provide you with usage of vacant area to own adult children, aging father and mother, native condo products, or companies. Funding an ADU is a frightening activity, however there are a few to be had options. Perhaps probably the most neatly-recognized is to make use of house assure. House homeowners is borrow on its existing security and use it to dollars the improvement off an enthusiastic ADU.

What exactly is an ADU?

An ADU, money develop or Connection Hang Instrument, is an additional living unit on a property that may be used for residential purposes. It can be connected to the primary house or detached from it and can be used as a separate residence, an workplace, or just extra space. ADUs are changing into increasingly standard as homeowners look for the way to increase the worth of their houses and accommodate changing desires comparable to growing older parents, grownup children, or company.

Previously, ADUs have left of the just about every other names such within the-rules merchandise, backyard cottages, grandma residences/pods, and pond domiciles. now not, legally, they go from the “connection hold products” and they’ve received skyrocketed within the dominance previously a decade. Several items keeps result in the elevated appeal to ADUs. The contemporary “lightweight domestic” infatuation, a boost in mature students residing with the mothers, and a the ageing course of kid boomer standard, all paired with elevated rising cost of living and that you could way of life will set you again, build ADUs a much more sexy choice than ever.

Depending on your budget, a prefabricated ADU can cost underneath $100,000, or, in case you go the custom-built route, can price a number of hundred thousand.

Where usually the recent new ADU be discovered? Might it probably be hooked up to your house? Are you right now changing a storage or different current room?

What is the intent in the back of my non-public ADU? Would it be utilized for web site guests, an place of business, a apartment, or any other objective?

Funding an ADU

There are various points to believe every time cash an enthusiastic ADU. Points to imagine are usually exactly how so much fairness you’ve gotten obtained for your possessions, your credit score, and you will undertaking prices. After getting calculated what it’s you have an interest in, it’s the right time to talk about your financial allowance, so they can guide your personal renovation challenge.

Enjoying with household safety to put money into an ADU

Possibly probably the most smartly-identified a method to finance an ADU used to be by the usage of home guarantee. Household equity ‘s the variation between exactly what your place of abode is value and you may your stability with it. For many who have gathered too much security inside the your house, you might use it to cover the constructing off a eager ADU.

A home fairness line of credit (or HELOC): A HELOC is a rotating line of credit score that’s secured through your major residence. HELOC processing can move fast, so you could get started for your venture quick. With a HELOC, you could have an introductory “draw duration,” the place that you could withdraw dollars as wanted, and are simplest required to make payments on interest. That is usually 10 years. That is followed by way of a “reimbursement duration” during which you are making payments on both the main and pastime.