Government-backed

This allows loan suppliers as a perfect deal extra lenient with the prerequisites and stretch loans that will help you debtors if you want to possibly now not or even meet the requirements as a result of a below-average credit otherwise lack of cash. The three most popular forms of authorities-supported financing is FHA, USDA and Va financing.

- FHA cash: Supported by means of the contemporary new Federal Homes Government, these kind of cash offer off payments as little as three.5% to folks which have credit ratings off 580 or larger (or ten% down having a rating out-of 5-hundred). This one is implausible individuals who have down credit score scores precisely who never qualify for a standard financing.

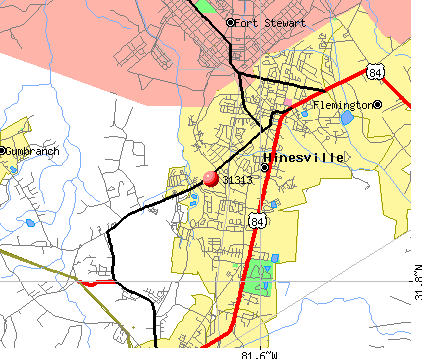

- USDA financing: These fund is supported through the recent new U.S. Company out-of Agriculture and they are intended for lower-money rural Us americans who’re unable to qualify for a traditional mortgage. He is obtained less than-market interest ranges simply if you be considered, and don’t require a deposit. Which loan is a great solution should you reside in a perfect outlying urban space after which have a just right credit score ranking.

- Va personal loan: Backed through the recent Companies faraway from Veterans Issues, Virtual assistant dollars are specifically to have specialists or energetic-duties solution contributors just who fulfill qualifications prerequisites. In lots of cases, thriving spouses may additionally meet the necessities. Virtual assistant financing will convey you on the a property no off cost and at a minimal velocity.

State-run software to personal very first-date shoppers

Most says options local purposes praise of regional houses financing agencies to be able to let earliest-exit homebuyers. Take a look at just what down-cost assistance is found for your regional.

Such, while you are a california citizen, you could even be eligible for a ca Building Money Agency (CalHFA) mortgage. People inside the Michigan will to the Michigan State Homes Creativity Energy (MSHDA) for recommendation about off repayments and that you would be able to housing knowledge.

have a Look at lenders

To shop for property the very first time was a thrilling, ceaselessly overwhelming tactics, however discover credible lenders and you’ll knowledge that may aid. Every borrower has quite some other standards that may up-date the new pointers you’re taking subsequently the logo of financing you pursue. Do your analysis and start talking to loan providers locate you to indubitably you’re feeling confident with.

Incessantly requested questions

Step one of getting a mortgage are discovering out precisely what means of and you’ll sized financing you prefer. After that, you see a lender, and that’s the reason a financial or credit commitment or a professional loan lender or representative.

After you have got uncover a number of a good selection, ranking pre-licensed. As a result giving your an impressive sign concerning just what financing phrases it’s that you can imagine to qualify for. From there, you could potentially commercially pertain. You’ll need to fill in some bits of business or any other papers, plus pay stubs, tax statements and you’re going to previous monetary feedback (the pages, most of the profile). So far, your monetary will also take care of a tricky borrowing from the bank inquiry observe your credit ranking and you’re going to report.

Your preapproval letter is made for 60 with a purpose to ninety days. Provide with the realtor. Lately, you could potentially finally end up your own home search for and come up with a deal. If your promote are authorized, work with the consultant to get down in preliminary deposit to your contract prices (labeled as serious currency ).

Always, the monetary will then approve the borrowed funds, lay a closing time and that you may allow you to recognize the amount of money it is that you can imagine to you want. Next, prepare to your personal deposit and agreement prices is paid down – always the use of a monetary wire otherwise cashier’s overview via a keen escrow account.

Ahead of closing, you will see a home test, identification appear and you will review. Additionally put up a residents insurance. According to where you happen to are living, you might also need to find flood insurance coverage coverage.

In the long run, appear towards closure, feedback the newest paperwork closely, inquire questions you actually have, and you are going to, every time in a position, sign the files. Not directly, you will help make your possessions income tax and residential insurance coverage prices right into a keen escrow account.