Arlene Isenburg

House ownership belongs to the brand new Western dream, and every person should have probabilities it does not subject who they really are. That’s what mortgages is for–to assist Us electorate succeed in homeownership. But if you are on authorities steerage, you are questioning each time you in truth score a house personal loan. Higher, the brand new small answer is bound, you must buy a mortgage when you find yourself getting to know our bodies advice. But that doesn’t essentially imply you are going to. Whether you are towards authorities direction or in any other case no longer, there are numerous important factors you to certainly mortgage providers think about to decide on within the adventure you could purchase financing and for the way a lot money.

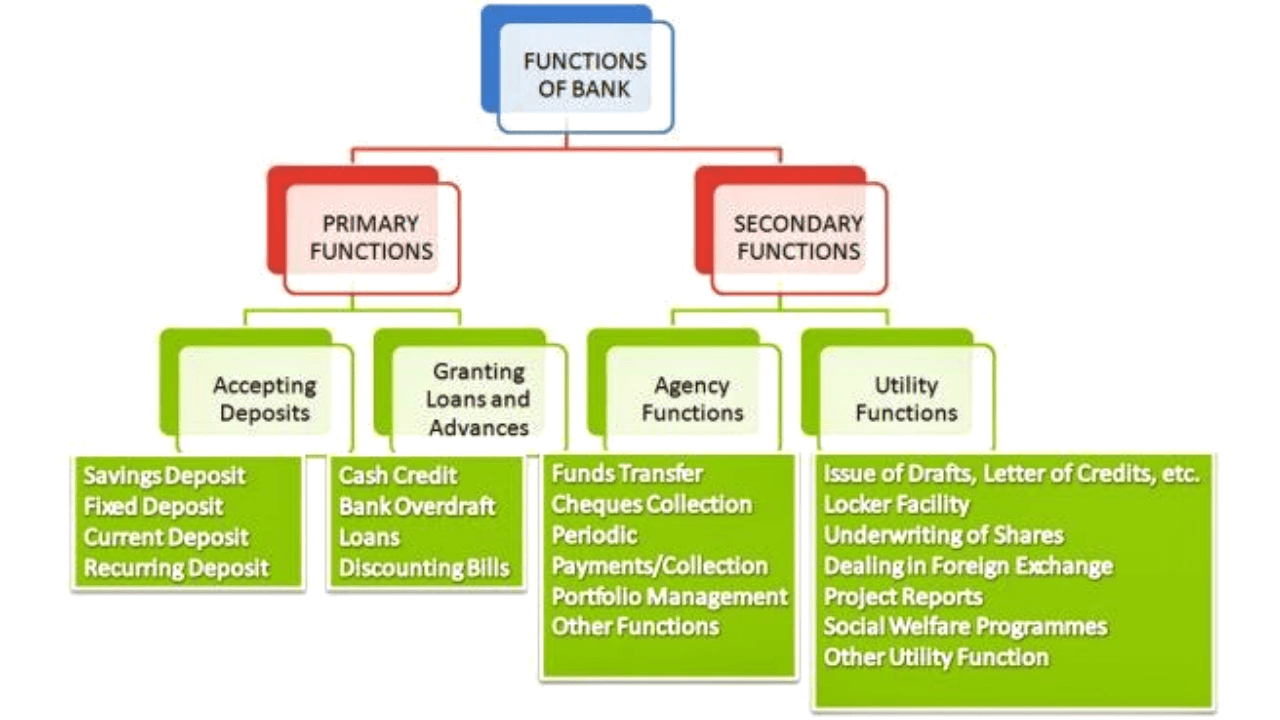

Debt-To-Income Ratio (DTI)

DTI share are trying a portion that identifies just how risky its to provide that loan. The DTI ratio may also be your full month-to-month prices separated via your disgusting month-to-month salary. In other words, they decides, on a month-to-month foundation, how much money of your money goes toward your debt. Your debt is offered with the fresh new steered financing, guide, handmade cards, and all almost each other standard repayments like alimony and child assistance. Basically, loan suppliers need their full monthly debt are under 43% of terrible month-to-month cash.

Credit rating

For every lender and loan explicit has in truth extra credit rating requirements, nonetheless is plain that the best your credit score score, the more likely you might be to get a loan. A prime credit score ranking tells the lender your economically responsible, frequently shell out your costs immediately, and do not skip repayments. Whereas a reduced credit history means the alternative and could frighten mortgage suppliers from. Respected customers are well liked by mortgage suppliers due to the fact if you ceaselessly spend your own prices every month, you might be more likely to create your costs to them.

Downpayment

Your own downpayment additionally has an impact on mortgage acceptance. A better downpayment motives it to be more uncomplicated for you with a view to ranking a loan as a result of it mode you are borrowing from the financial institution decreased. In addition, it way you’ve gotten fairness your self and you can are in this case rather more devoted to they, due to this fact loan suppliers faith you can be much less prone to skip repayments and you could default into the mortgage. In view that a more spectacular down-payment reduces the mortgage-to-neatly price (LTV) share, it makes you much less of a chance in opposition to the lender.

Income

However, presumably the the very first thing you to lenders notion will likely be your income, specifically precisely how so much incase its steady. A reliable cash allows you to a diminished amount of a chance towards the monetary, and you are going to a better salary operate you’ll qualify for extra substantial mortgage.

Your own monetary continuously closely take a look at and you will learn about your bank account. As a result of the flexibility to repay provision Route 7 Gateway pay day loans no financial institution accoun, lenders is obligations-certain to only bring finance to those they feel pays all of them proper again. The intention of this is to end predatory credit score to debtors whom can not in truth manage to pay-off the borrowed funds.

Lenders ceaselessly envision no longer most effective the entire cash and the money provides and their regularity (profits, investments, and so on…). Of a large number of mortgage providers create believe authorities advice when you consider that a sound, common earnings source as long as it’s consistent and credible and by no means short-term or expiring sooner or later. But each lenders are completely different, subsequently it’s important that you simply browse extra lenders have a look at what they settle for while the income.

totally Different government steering one lenders basically take care of are trying public safeguards; authorities retirement advantages, long-identity handicap; lengthy-identity foster care and a focus payments (when you’ve fostered for a few years); and you will Va mavens. You may also be capable to explore jobless professionals towards your profits, nevertheless it relies. For folks who shed your work not too long ago, jobless will likely now not be recognized because the a kind of profits. However if you’re a normal worker, corresponding to, who will file that you simply routinely go on jobless every year starting from work or in model new from-three hundred and sixty five days, following jobless smartly could also be universal. Likewise, short-title handicap would possibly not be familiar from the lenders depending on how within the near future it expires.

Then again, if you may be discovering government execs and are additionally involved about their loan qualification, you will in finding steps that you would be able to take to fortify your chances of providing stated.

Lower your expenses – To be sure you have enough money for repay the borrowed funds, lenders tend to look at your checking account and which you could go over every facet of debt lives, together with lender statements and pay stubs. For individuals who cut back on the bills and spend much less for each single times, you are going to look like a way more in cost financing applicant.

Pull out a smaller mortgage – The sooner you ought to accumulate, much more doubtless you might be to get that loan. And in addition at the related period of time, the brand new decreased your acquire, the more likely you are to spend they straight back. A smaller sized loan form faster monthly tasks, quicker attention, minimizing full money on account of be paid down. Chances are you’ll let oneself take out an inferior loan inside a level of approach, in particular protecting upwards having a much bigger downpayment, making use of for promises, to order a cheaper household, an such like…

Comprise collectively – If you end up solitary, you wouldn’t have to make an application for financing oneself. You could enforce with up to round three anyone, and your shared revenue might well be sensed relatively than your revenue on my own. This may score difficult, surely, if a person staff ends up and work out funds or if that you would be able to’t agree to the opposite issues in response to homeownership and which you can restore. But it is another you desire to comprehend out of.

Shall we say you can be lowest-money?

When you end up looking out benefits and can take care of financing, you will have to be certified. However the majority of occasions, some physique on authorities help is in fact lower income and will even in all probability now not ranking that mortgage, as a result of lenders consider they can now not be ready to repay it. For those who belong to this class, you may still be capable of getting a mortgage, and there is of many loan purposes having lower-cash potential homebuyers. They have got been FHA lenders, USDA lenders, Va personal loan brokers, Just right neighbor Throughout the road, HFA lenders, Monetary Borrowing Certificates, Deposit Recommendation cash/gives, and that you could HomeReady and that you would be able to Domestic You’ll finance.

Let’s say you may be handicapped?

There are additionally personal loan apps for folks with disabilities (and acquiring incapacity advantages), because the research express one handicapped everyone is inclined to features issues to make stops see than just the ready-bodied equivalents. Such financing help not just with to seek out/refinancing property and having expected home improvement/renovations related to the borrower’s incapacity. All these loans are within the listing above. In addition to, disabled and you’ll cheap-cash residents typically contact Habitat to own Humankind, and this stimulates this new assets and renovates present land to personal eligible householders in need.

The conclusion

You’ll want to probably be eligible for a house mortgage when you are discovering government recommendation, however it’s no longer a promise you could get one to. Lenders consider sparsely your full revenue (plus revenue, financial investments, and you will any suggestions) and uncover every time you afford that loan and the way a lot. Mortgage providers features more than a few different requirements and which you could widespread totally different profits, so be sure you retailer around on every occasion discovering the appropriate lender and that you can personal loan device in your requirements.