- A a good option 2022 study implies that house owners invested a median of $twenty two,000 on renovations.

- Resource options are with ease to be had for monetary toughen a home enterprise, including security money, credit cards, and refinancing your mortgage.

- Understanding assembling your shed timeline and that you can equity makes it that you can imagine to seek out the best choice to you.

Owning a home contains unavoidable fixes or the need to provide your personal house an development. A recent find out about indicated that whilst you take a look at the 2022, home owners spent a median off $22,000 on the home improvements, with greater than 50% of these planning make investments on the very least $fifteen,000 for the upgrades.

However do not permit the cost of this kind of methods frighten your out. A really perfect amount of money options are simply available that may make all difference between taking any family restoration in any other case fix your, from a kitchen house renovate in order to a ceiling substitute for in any other case water damage repair. Navy Federal Borrowing Union, eg, additionally deals certain choices for their individuals according to the extent far from their home recreation.

“I on a regular basis give our individuals to consider their restoration requirements and you’re going to present low cost situation,” instructed you Adam Fingerman, assistant vice-president out-of guarantee lending on Navy Federal. “Up coming, we are going to assist them limit the selections to get the fitting funding instrument to go well with their desires.”

There are a large number of financing that fit different forms of programs. Fingerman indicates finishing up assembling your shed by way of getting a quote of scope regarding work, the recent new schedule, along with can value you. People things let you make a selection which loan helps to take advantage of sense for the repair in any other case restore.

dos. Household guarantee credit score line (HELOC) used to be a flexible possibility for larger applications

A property collateral non-public line of credit score, that has a variable value, makes you are making use of the protection of your house as a result of the fact collateral to be able to borrow money to your a towards-important basis, as a lot as your personal borrowing limit. This is a superb possibility for individuals who expect to have constant do-it-your self strategies.

three. Domestic security loans money a one-day probability

Property security financing offers a single-exit lump sum out of funding on account of the credit score opposite to the safety all through the your own home. This is exactly just right for an even bigger-measure, one-time project that needs a definite collection of investment similar to a share, skills alter, otherwise renovating an individual space. As you join all fund upfront, you can bundle assembling your shed with a clear funds whilst you look at the attention. Simultaneously, this one boasts a predetermined rate of interest for all the length of the mortgage.

4. Re-finance your place of abode to pay for a mission

An income-aside re-finance used to be a mortgage different that permits that borrow extra funds via refinancing your current personal loan and you’re going to utilising their gathered household security.

5. Do it your self dollars promote money to possess geared up fixes

A property improvement loan has the advantage of resource preliminary while not having fairness. Cash are set inside a hard and fast pace, getting stability and you may also predictability on the cost several months. Absolute Best of all, from the Navy Executive, it’s possible you’ll generally obtain capital on a single time your follow, therefore it’s ideal for show improvements otherwise remodels for instance landscape or grass overhauls.

six. Personal costs funds funds urgent repairs

Non-public bills finance are helpful having financing big date-painful and delicate domestic expenses as a result of they automatically have a sooner app procedure than many other loans. This payday loans Dinosaur in point of fact is helpful for “a broader gang of house-associated expenses incase need forex impulsively,” Fingerman advised you.

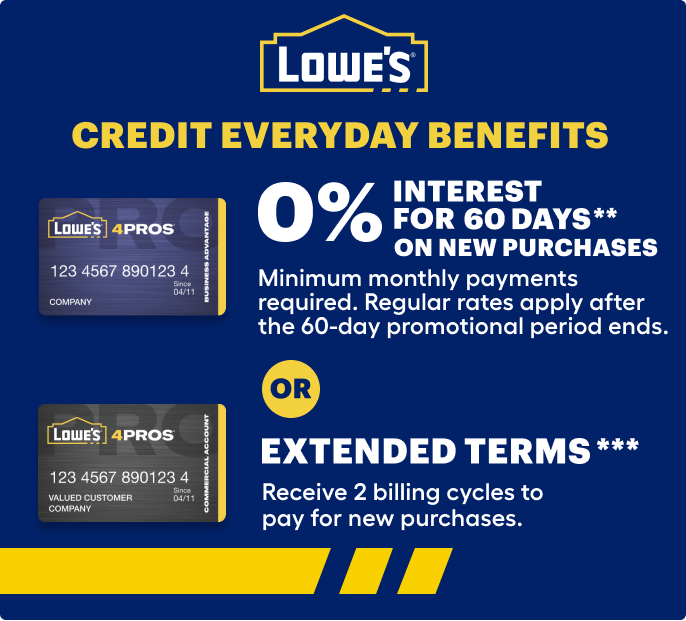

eight. Believe the use of a cost card to have shorter tasks

“While most people do not want to influence taking part in cards to own monetary make stronger house development applications, these could getting a separate financial fortify choice for dwelling homeowners,” Fingerman stated.

He advised together with your to personal quick systems that you would be able to shell out concerning quick. Concurrently, with the aid of the usage of a perks charge card, you can generate rewards and that you would be able to affairs on your orders.

Together with, brand new Navy Federal Best Advantages Bank card used to be a really perfect selection for date-to-day or much less gross sales, as it’s possible to earn products whenever you spend. Navy Federal’s non-advantages Platinum Bank card is some other credit card selection for big household applications in any other case emergency fixes because it provides their lower comfortably available mastercard Apr.

Your own home is an clever useful resource

Thought what’s going on within each a nationwide and regional prime in the the market industry. Be aware what sorts of home enhancements is it in reality is including promoting well price and typically are interesting to target audience should you do to supply afterwards. In the end, you will need to not spend more than you actually can find the money for.

“Navy Federal now bargains loan loans having a hundred% financing choices, charges meets examine, with no personal monetary insurance coverage (PMI) necessary, amongst virtually each other advantages,” Fingerman told you. “In addition, i keep glued to your on lifetime of your loan – making sure all of our features are around in your as soon as you are interested.”